High-tech startups, hailing from Silicon Valley, and large, well-established banks, hailing from Wall St couldn’t be more different. Yet the golden opportunity of FinTech holds the promise of (somehow) bringing them closer together. This post isn’t about disruption, executive pay, alternative credit scoring models or other topics du jour. It’s about a possible future where alpha hunting, compliance, insider trading, fiduciary obligations and financial regulation converge in a potentially awkward way for startups.

Proprietary trading means a bank trades its own balance sheet for profits. Contrast this with asset management, where a bank trades client deposits. The definition gets murkier when banks trade client positions as well as their own. Seems absurd this could even happen, but with enough lobbying, anything can happen. In the wake of the Great Recession, major banks were caught betting against their customers. The post-crisis Dodd Frank legislation included the Volcker Rule, which essentially forced banks to spin off prop trading groups, so the conflict of interest theoretically went away.

Which brings us to startups… I’ve been interested in the derivative uses of data for some time and continue to research the area. An increasing number of startups log, and alpha-chasing funds seek, data that can leverage signal and provide an information edge. A popular example is Foursquare’s location data used to estimate earnings for Chipotle and several other examples.

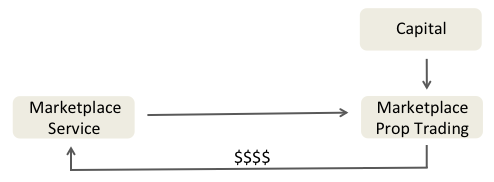

Now imagine if the startup decided to trade on this insight rather than sell/broadcast data or signal. To make it worthwhile it would have to be heavily leveraged, and it’s doubtful investors would be excited about fattening up balance sheets for gambling. In this example (below), the startup (“Marketplace Service”) performs analytical techniques to tease out signal and trades using this insight at the core of the strategy. Supplement with outside capital to increase returns and return profits to the startup (or related entity). Online lender SoFi is sort of doing this, but with relative transparency and checks/compliance. Most importantly, the fund is not betting against SoFi.

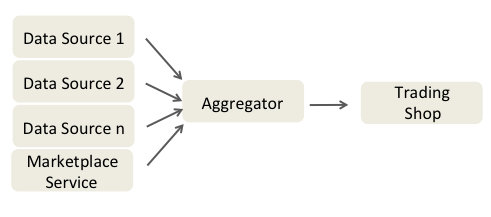

There are a large handful of boutique firms that license/aggregate data and make it available for alpha-seekers or other purposes. Some of these firms provide their own signal others provide raw data, others act as brokers, some cleanse/refine and perform other activities. These are illustrated in the graphic below.

Now to the fun (for me, anyway!) thought exercise– imagine the below examples coming true. I didn’t want to use actual company names, but the informed reader will get the idea.

- Navigation app – Navigation apps, location SDKs in apps and related services tell us who is where and when. In aggregate, this can be used to understand macroeconomic activity or performance in retail, a la Foursquare. Baidu’s Big Data Lab has published research in this area and 600m users is enviable.

- Marketplace for services – If a marketplace/aggregator has a solid read on (collectively) who is eating where and when, how home contractor usage is trending or how airline ticket sales perform compare year over year or any number of areas, there could be some serious signal with a strong information edge.

- A global job posting/career website – By knowing who is hiring, which skills are sought/available, what areas of the workforce are most frequently changing jobs, a trading strategy could leverage this insight in several ways.

Insider trading, breach of fiduciary, conflict of interest and reputational risk are several issues that should be explored before embarking on any kind of prop trading activity. However, startups tend to be good at one thing–growing their own business. There’s also a massive difference between a data scientist analyzing log data in support of a product and a small group of highly focused PhDs using a variety of novel analytic techniques to discover signal. Trading plus high-growth startup is a formula for potential disaster or sneaky success.

I’ll be publishing more thoughts on the general topic of alpha chasing and derivative data, and look forward to your comments and criticism.